A billion for your thoughts

Why billionaire Ron Burkle's interests should

interest you

Ron Burkle

Undated photo courtesy

www.freerepublic.com

By Daniela

Kirshenbaum and Kepa

Askenasy, Fog City Journal I-Team

December 1, 2006

A billionaire's biggest problem is that a billion dollars aren't

enough. In a natural quest for ever-greater sums of money, Billionaire

Ron Burkle intends to bankroll Treasure Island development - and

maybe gain some hefty media control, too.

+ + +

Billionaire Ron Burkle once bagged groceries for his father's

chain of supermarkets. Now he can expect more than just riches

and celebrity friends. He stands to gather yet more riches with

the aptly named Treasure Island. Perhaps more ominously, he could

also start gaining some control over the media industry should

he win the battle for the Tribune companies.

To San Franciscans, his business interests are worth following.

In what has been called a "sweetheart

deal," Burkle is set to be the premier profit-maker at

Treasure Island by financing its development. This would likely

be on account of his astonishing resources, and, more strategically,

the connections of his former employee, Darius

Anderson. (Anderson has appeared previously in a Fog

City I-Team story on Treasure Island.)

Anderson is a very high-stakes player in some of the most lucrative

Bay Area land deals. It must have seemed logical to shut out other

interested parties and bring Burkle, and his sizable fortune,

into the exclusive partnership called Treasure Island Community

Development, LLC.

Calls to Platinum Advisors, Anderson's firm, were not returned.

It would have been worth asking why anyone, particularly a billionaire,

would tempt negative attention by entering into the kind

of deal that requires assistance

from local politicians.

Like many ultra-wealthy individuals, Burkle doesn't keep a particularly

high profile. But attention

comes with all that money; some of it is the kind few people

deserve.

+ + +

Ron Burkle lives in Los Angeles and engages in the sort of activity

that's reported mostly in business pages. His investment firm,

Yucaipa

Companies, is known mainly for masterful acquisitions and

mergers of grocery and retail chains: Pathmark, Fred Meyer, Kroger,

and the like.

Burkle's La Jolla pleasure dome

Photo by John

Walkenbach

Since former military bases present such rare and golden development

opportunities, a land use deal like Treasure Island might have

been hard to pass up, even for an individual normally associated

with grocery stores. But what of Burkle's more recent moves into

the media business? How did Burkle's current

bids for ownership of the Tribune Co., a giant media conglomerate

comprised of 25 TV stations, several important newspapers, and

a baseball team, come about?

Burkle's spokesperson at the Yucaipa Companies, Frank Quintero,

was vague on all matters. He said he did "not know that we

could be described as a major investor" at Treasure Island.

(Burkle is a principle investor.)

And then Quintero dismissed questions on the move from grocery

stores to media chains: "It's not a new area of investment

for us. We have a very diversified portfolio that we've developed

over the past 20 years." But besides Burkle's being named

to the board of Yahoo! Inc. in 2001, there is no discernable trace

of his involvement in media businesses.

Linda Foley, President of the Newspaper

Guild based in Washington, D.C., acknowledged that Yucaipa

"had only dabbled before in a peripheral way" with media

companies. But she said that earlier this year, Burkle and Yucaipa

seemed to understand not just the profit in a potential separate

take-over of several Knight -Ridder newspapers, but the needs

of the workforce as well. (Yucaipa did not wind up with the Knight-Ridder

papers.)

And, regardless of Yucaipa's lack of experience in any press

room, Josh Silver, Executive Director of the non-profit Free Press,[www.freepress.net]

noted that Burkle could be considered a much better owner than

a huge, profits-only media corporation like Gannett or Clear Channel.

Being a Los Angeles local, Burkle might have more of an interest

in competent local news coverage by the Los Angeles Times, one

of the dozens of "properties" belonging to the Tribune

Co.

Or not: Silver added that ownership of a newspaper or media outlet

gives one an enormous amount of political influence. "The

owner will set the tone for the paper," he said. "Look

at Rupert Murdoch at the New York Post."

+ + +

Burkle is familiar with politics, beyond the influence-wielding

that led to the Treasure Island booty. He is often referred to

as a friend of Bill Clinton, and has been known to throw a big-ticket

political fundraiser or make sizable political donations.

News reports suggest that not all of Burkle's political motives

are altruistic. His venture capital funds were filled with $700

million of cash from CalPERS,

the California state employee pension funds. This was after Burkle

made campaign donations to Willie Brown, Phil Angelides, and over

half

a million dollars to the campaign of then-Governor Gray Davis.

Once Schwarzenegger looked like the next governor of California,

Burkle donated

$121,000 to his campaign.

Other billionaires have found themselves in the similar position

of operating easily in financial and political circles, to the

benefit of both. And often they come to the same conclusion: the

missing ingredient of power is the media.

Silvio Berlusconi, until recently Italy's prime minister, took

this lesson to extremes. A billionaire with vast holdings and

limitless arrogance, he methodically set about gaining financial

control of so much of Italy's press that he eventually owned

most of Italy's viewership outlets. And that influence, critics

say, led to political influence that retroactively changed laws,

keeping him out of legal trouble and prison.

This isn't terribly unusual these days. Very recently, Billionaire

Maurice Greenberg decided to make

a play for the New York Times Co. itself. It would seem that

fury over the way he was covered in the Times led to this interest

in journalism.

+ + +

And what could have led to Ron Burkle's journalistic interest?

In April, there was a nasty extortion case that got splashed in

the papers; a gossip columnist tried to shake down Burkle in exchange

for keeping

unplesant items about him out of the New York Post.

And over the past few years, there has been a lot of back-and-forth

in Burkle's messy

divorce. Gossip columnists might love to get hold of a billionaire's

legal divorce proceedings; that's always been a traditional agony

with a high-profile divorce. But no - in 2004, Governor Schwarzenegger

signed new legislation sealing the divorce

papers.

Mr. Burkle's spokesperson declined to answer further questions,

but it would appear that there is ample motivation for Burkle

to delve more firmly into the media industry. And a new delay

in the auction process for the ever-more-desirable Tribune Co.,

reveals he may have lined

up the Carlyle Group, one of the heaviest hitters of them

all, to join

his Dream Team in acquiring it.

The Tribune Co., and readers of the Chicago Tribune, the Los

Angeles Times, the Baltimore Sun, and so many others, may be consumers

of Burkle's news and media vision whether they care to be or not.

The Carlyle Group, affectionately known as an investment club

for former U.S. presidents, doesn't play around. Based in Washington,

they are experts at profiting from the intersection of military,

industrial, and political winds.

And to think San Franciscans were focused only on whether there

would be affordable housing units built on Treasure Island, lulled

into complacency by the plans for organic gardens to be set amidst

the 40-story condo towers.

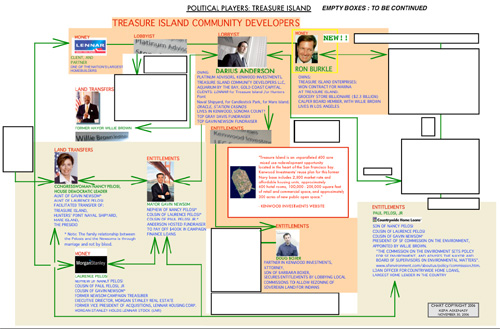

Political Players: Treasure Island

(click on the image below to see a larger

version of the chart)

Additional Information:

Palm

trees, views, art deco buildings… Virtual tour of Treasure

Island

What

happens in Ron Burkle's life is serious business news

####

Editor's Note: Views expressed by columnists

published on FogCityJournal.com are not necessarily the views or beliefs of

Fog City Journal. Fog City Journal supports free speech in all its varied forms

and provides a forum for a complete spectrum of viewpoints.

|