A rally in support of a Board of Supervisors resolution co-sponsored by six supervisors, calling for the suspension of foreclosures in San Francisco, was held today on the steps of City Hall. Photos by Christopher D. Cook.

By Christopher D. Cook

March 20, 2012

As a tidal wave of home foreclosures sweeps across San Francisco neighborhoods, displacing more than 12,000 city residents since 2008, dozens of community activists and several city supervisors today called for a suspension of foreclosures — rallying around a resolution by Supervisor John Avalos to stop local foreclosures and support the California Homeowner Bill of Rights.

The rally on City Hall steps, organized by Occupy Bernal Heights and the Alliance of Californians for Community Empowerment (ACCE, formerly known as ACORN) featured several “foreclosure fighters,” residents who are on the verge of losing their homes.

“We are not asking for a handout, we’re just asking for modifications of our loans,” said Ernesto Viscaro, a struggling homeowner and member of Occupy Bernal.

Homeowner and foreclosure fighter Ernesto Viscaro.

Homeowner and foreclosure fighter Maria Villareal.

Another homeowner, 63 year-old Kathryn Galves, told the crowd that her Noe Valley home, which she shares with her sister and her dog, is slated to go “under the sheriff’s [foreclosure] axe tomorrow.” She listed a litany of health problems including high blood pressure and a kidney ailment that she says have been exacerbated by the stress of the impending foreclosure of her home by Wells Fargo.

At the end of the rally, a member of ACCE announced that her eviction had been postponed for a week.

Following the rally, Supervisor Avalos introduced a resolution – co-sponsored by Supervisors David Campos, Christina Olague, Jane Kim, Eric Mar and David Chiu, “Urging city and county officials and departments to protect homeowners from unlawful foreclosures.” The measure also urges mortgage and banking institutions, “especially San Francisco-based Wells Fargo,” to “suspend foreclosure activities and related auctions and evictions.”

The resolution cited a recent $26 billion settlement agreement between the US Department of Justice and five major banks, including Wells Fargo, “over findings of misconduct in foreclosure activities.”

Wells Fargo representatives did not return repeated requests for comment.

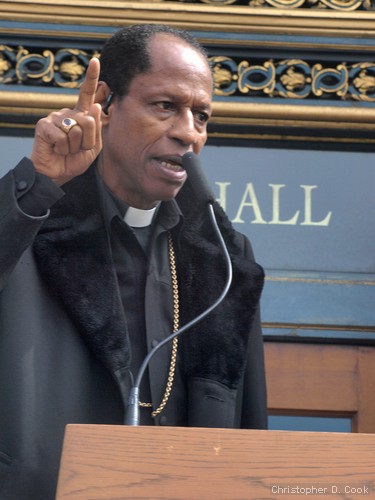

One speaker who is under threat of foreclosure, Archbishop Wayne King of Bayview, said the foreclosures are “destroying our communities”– but he said embattled homeowners are fighting back. “We are being preyed upon by some gangsters, thieves and thugs. I’d rather borrow money from Al Capone…It’s like someone threw an alarm clock in the graveyard and we woke up.”

Homeowner and foreclosure fighter, Archbishop Wayne King.

Avalos, whose own family home is “under water about $100,000,” said the foreclosures are not only wrecking communities, they are undermining the future of a whole generation. “Our property is our wealth,” he said. “This is how we pay for our kids going to college, how we pay for our medical care… We have seen a whole generation that has lost its wealth, and we are here to fight back…We are drowning in our mortgages and we need to get relief.”

But, “a postponement is not enough,” said District 9 Supervisor Campos. “We need a moratorium on foreclosures in San Francisco. We are asking all city agencies to not play any role” in administering foreclosures, he said.

District 5 Supervisor Olague argued that foreclosures affect renters, too; that they are endangering the city’s economic and racial diversity. According to the resolution, more than half of the foreclosures in San Francisco (6,279) have “occurred in San Francisco’s predominantly African American and Latino communities.”

The Hunger Site

The Hunger Site

April 19, 2012 at 5:04 am

Please check on Sheila Walsh, 112 Judson Ave (nr City College) 587-9387, sheilawalsh2001@yahoo.com. She’s a senior who was trying to deal with Wells Fargo on her own.

March 22, 2012 at 1:10 am

Foreclosure and Corruption make homeowners literally DYING for an answer. Day 2 – Homeowner goes on hunger strike in front of Attorney General Kamala Harris’ SF office, dying for justice. http://www.nojusticezone.com

March 22, 2012 at 1:10 am

Foreclosure and Corruption make homeowners literally DYING for an answer. Day 2 – Homeowner goes on hunger strike in front of Attorney General Kamala Harris’ SF office, dying for justice. http://www.nojusticezone.com

Source: The Bay Citizen (http://s.tt/17xBT)

March 21, 2012 at 3:25 pm

Yet another reason to establish an SF Municipal Bank and continue bank transfers to local credit unions.

We disinvested in S Africa, that worked, we need to take similar actions against Wall Street and the To Big to Survive Banks.

March 21, 2012 at 7:31 am

Hey now wait a minute. . . District 9 Supervisor Campos. “We need a moratorium on foreclosures in San Francisco. We are asking all city agencies to not play any role” in administering foreclosures, he said.

Does David Campos realize that he is urging Assessor Phil Ting and Interim Sheriff Vicki Hennesey, and or employees in the Assessor or Sheriff’s office . . .Those are the only two other City officials, aside from San Francisco Superior Court Judges, who have any authority in this.

I’m all for it, but, what is the Board going to do to protect these officials he seems to be urging to break the law by refusing to do their jobs?

Sheriff Mirkarimi seemed to be willing to push at the limits of his authority in this, but he knew that the best he could do would be to delay some evictions as former Sheriff Hongisto did years ago at the I-Hotel, and as have three Sheriffs around the country, who finally buckled at doing more foreclosure evictions. (Suspended) Sheriff Mirkarimi told me he had talked to all three of them, during his campaign, knowing he’d be facing this, and found that none had been able to refuse the legal obligations of their office for long without facing removal.

Now Mirkarimi has been suspended anyway, and I doubt Vicki Hennessey will take any chances on this with her controversial authority as Interim Sheriff.

And, though Assessor Phil Ting’s audit concluding that 84% of San Francisco forelosures were “probably illegal” was groundbreaking, he stopped short of saying they WERE illegal or that 84% of pending foreclosures ARE illegal, because he’s neither a lawyer nor a public prosecutor and has no power to enforce.

And now Phil Ting’s not even advocating legislation making California a judicial foreclosure state – meaning a state in which banks would have to go to court and prove they have standing to foreclose before doing so. State lawmakers aren’t either, and it’s hardly surprising because most foreclosing banks would now find it impossible to prove that they do have standing to foreclose, and California is one of the most bank friendly states in the country.

I’m sure there’s plenty of pressure about this behind closed doors. Former State Assembly Majority Leader Alberto Torrico said to me, in 2010, “I had no idea how much power these banks have till I served on the banking committee.”

So, much as I’d like to applaud what seems to be Supervisor Campos’s proposal that public officials, including the new Interim Sheriff, defy the law with revolutionary acts, neither he nor other members of the Board are going to be the ones arrested or removed from office if they do. Unless they’ve got something else in mind that they’re not talking about here. If they do, I’d like to hear about that.