Articles Tagged “federal reserve”

-

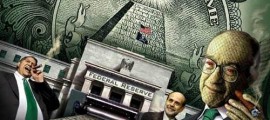

Time to Make the Fed a Public Utility

December 23rd, 2013, marks the 100th anniversary of the Federal Reserve, warranting a review of its performance. Has it achieved the purposes for which it was designed?

-

The Federal Reserve: An Insight into the Most Powerful US Economic Body

Initially the Congress had established three major objectives for monetary policy: maximum employment; stability of prices and interest rates in the long term being moderate. Most often the first two objectives are referred to as the dual mandate of the Federal Reserve.

-

Pulling Back the Curtain on the Wall Street Money Machine

The Fed, it seems, was doing only what banks and the money market do for each other every day: making “liquidity” available at very low interest rates. In 2008, bank liquidity dried up after Lehman Brothers collapsed, and the banks could not get the cheap, ready credit on which their lending scheme depends. The Fed then stepped in as “lender of last resort,” doing what it had to do to keep the banking scheme going.

The Hunger Site

The Hunger Site

Recent Comments